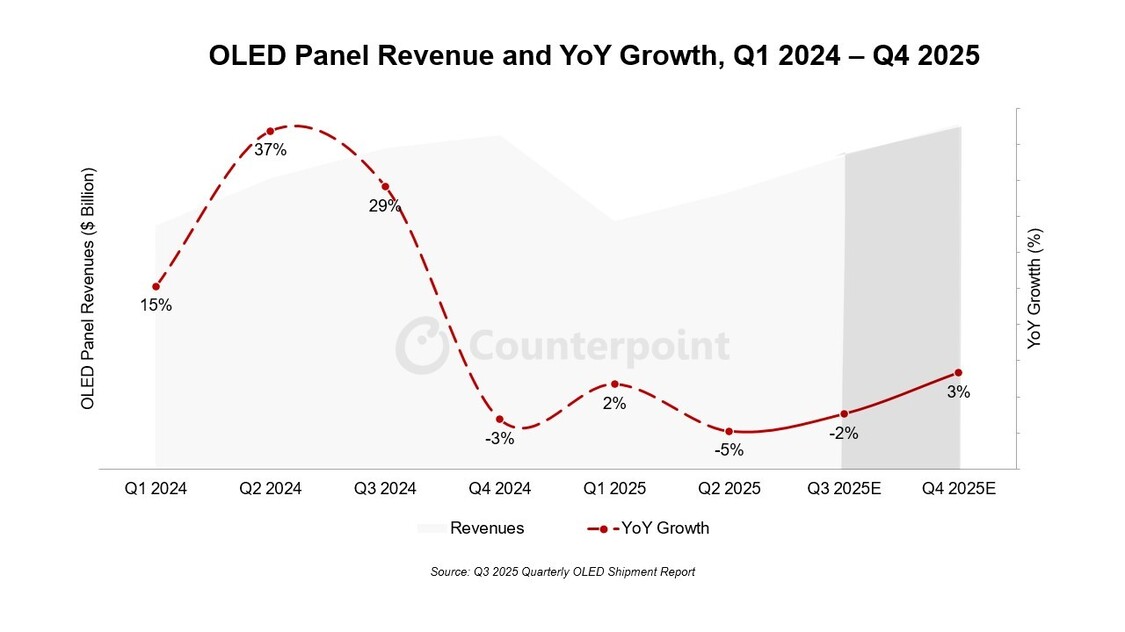

According to a blog post published yesterday (October 8), market research firm CounterPoint Research forecasts a 1% year-on-year increase in OLED panel shipments and a 2% year-on-year decrease in revenue for the third quarter of 2025. Sales growth in this quarter is primarily concentrated in monitors and notebooks.

The firm noted that global OLED panel revenue declined 5% year-on-year in the second quarter of 2025, but the year-on-year decline narrowed to 2% in the third quarter due to a 2% year-on-year increase in smartphone panel shipments and double-digit year-on-year growth in monitor and notebook shipments.

Overall, the firm believes that total OLED panel revenue will decline slightly in 2025, supported by a strong demand recovery and new OLED production capacity, but will rebound more strongly in 2026. Driven by smartphones, notebooks, and monitors, OLED panel shipments are projected to grow approximately 2% year-on-year in 2025.

https://www.china-digitalsignage.com/Products/Digital_Signage/310.html

https://www.china-digitalsignage.com/Products/Digital_Signage/309.html

https://www.china-digitalsignage.com/Products/Digital_Signage/308.html

Looking at the manufacturer breakdown, IT Home provides a brief overview based on the blog post:

Samsung Display

In the second quarter of 2025, Samsung Display's share of OLED panel shipments climbed to 35%, and its share of value reached 42%, thanks to triple-digit sequential growth in laptops and smartwatches, as well as double-digit sequential growth in TVs.

The agency projects Samsung Display's value share to reach 44% in the third quarter of 2025, and 41% for the full year, slightly lower than 42% in 2024.

LG Display

In the second quarter of 2025, LG Display's panel area share increased to 38%, but its panel revenue share declined to 21%. This was primarily due to a double-digit sequential decline in smartphone shipments, partially offset by double-digit growth in TV shipments and single-digit growth in smartwatch shipments. LGD's revenue share is projected to be 22% in the third quarter of 2025 and 21% for the full year, down from 23% in 2024.

BOE

BOE's unit and value share declined to 9% and 15%, respectively, as double-digit sequential growth in smartphones and notebooks was offset by double-digit declines in smartwatches.

The agency projects BOE's revenue share to remain at 12% in the third quarter of 2025 and to stabilize at 14% for the full year, the same as in 2024.

Tianma

Tianma's OLED unit share fell to 5% in the second quarter of 2025, and its value share also fell to 6%. Although the company's lack of OLED TV production limited its value growth, its revenue grew 8% sequentially, supported by demand for smartphones and smartwatches. Tianma's shipment share is expected to reach 6% in the third quarter of 2025 and 6% for the full year, up from 5% in 2024.